随着消费需求的持续升级与产业数字化转型深化,中国饮料市场呈现多元化发展态势,主要体现在以线上直播购物、智能无人售货为代表的消费渠道升级,以低糖配方、功能成分为核心的健康需求驱动,以及以气泡水、电解质水为热点的品类创新趋势三大方向。根据全球新经济产业第三方数据挖掘和分析机构iiMedia Research(艾媒咨询)最新发布的《2025年中国饮料行业市场消费行为调查数据》数据显示,奶制品以51.70%的认知度位列消费者饮料类别了解榜首,显示出健康化需求对品类认知的显著影响。

从消费渠道来看,综合电商平台以61.31%的线上渗透率主导购买场景,而线下大型生活超市则以65.65%的占比保持核心地位,印证全渠道融合的消费特征。价格优惠以33.03%的比例位居榜首,显示价格因素对饮料消费的促进作用最为显著。当前市场仍存在结构性矛盾:线上渠道依赖内容平台推广来加速品牌曝光中涂品牌网,但同质化营销易引发审美疲劳;线下渠道虽维持高流量,但即时性需求与场景化服务能力仍需强化。艾媒咨询分析师建议,企业需构建差异化价值体系,通过水质技术升级、包装设计创新来提升产品溢价空间,同时依托大数据分析实现价格策略动态调整,精准匹配家庭囤货、户外运动等细分场景需求。(《艾媒咨询 | 2025年中国饮料行业市场消费行为调查数据》完整高清PDF版共95页,可点击文章底部报告下载按钮进行报告下载)

With the continuous upgrading of consumer demand and the deepening of industrial digital transformation, China’s beverage market shows a diversified development trend, mainly reflected in the upgrading of consumption channels represented by online live shopping and intelligent unmanned vending, the health demand driven by low-sugar formula and functional ingredients, and the category innovation trend with sparkling water and electrolyte water as the hot spot. According to the latest “Market consumption behavior survey data of China’s beverage industry in 2025” released by iiMedia Research, a third-party data mining and analysis institution in the global new economy industry, dairy products ranked the top of the consumer beverage category understanding with 51.70% awareness. The results show that the demand for health has a significant impact on category cognition.

From the perspective of consumption channels, the integrated e-commerce platform dominates the purchasing scene with an online penetration rate of 61。31%, while the offline large life supermarket maintains its core position with 65。65%, confirming the consumption characteristics of omni-channel integration。 Price preference ranked first with 33。03%, indicating that price factors had the most significant promoting effect on beverage consumption。 At present, there are still structural contradictions in the market: online channels rely on content platform promotion to accelerate brand exposure, but homogenized marketing is easy to cause aesthetic fatigue; Although offline channels maintain high traffic, the real-time demand and scenario-based service capabilities still need to be strengthened。

iiMedia Research suggest that enterprises need to build a differentiated value system, improve product premium space through water quality technology upgrading and packaging design innovation, and rely on big data analysis to achieve dynamic adjustment of price strategies and accurately match the needs of segmentation scenes such as family hoarding and outdoor sports。 (“iiMedia Report | Market consumption behavior survey data of China’s beverage industry in 2025” full version has 95pages, please click the download button at the bottom of the article to download the report)

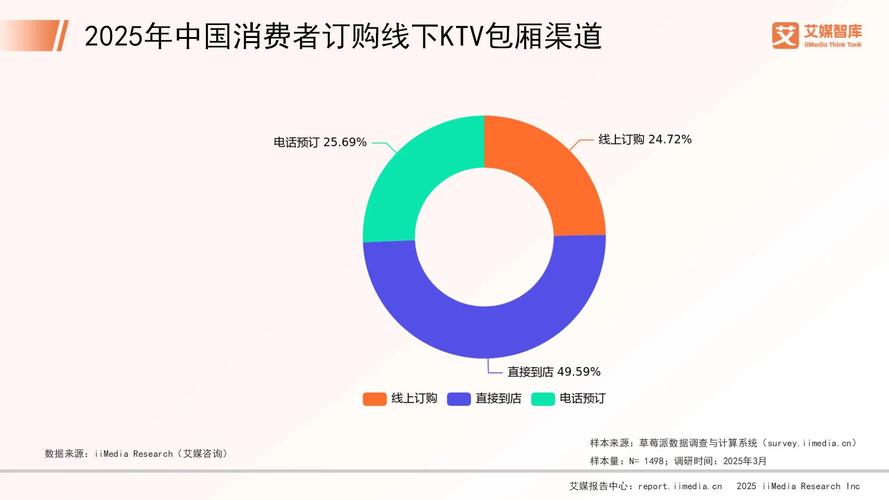

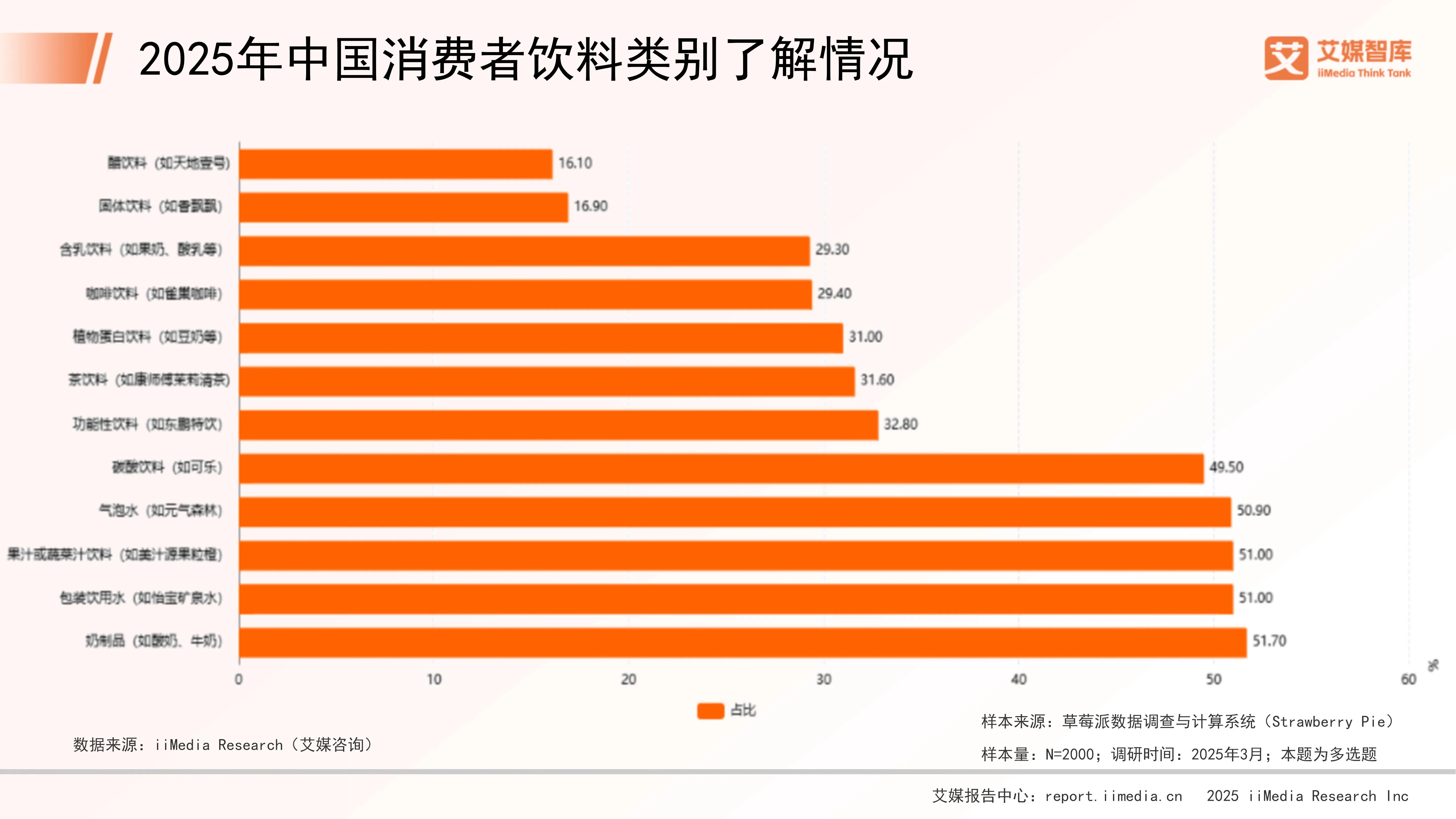

2025年中国消费者饮料类别了解情况

数据显示,奶制品(51.70%)在2025年中国消费者饮料类别了解情况中占比最高,显示出消费者对这类饮料的高认知度。包装饮用水(51.00%)和果汁或蔬菜汁饮料(51.00%)紧随其后。气泡水(50.90%)和碳酸饮料(49.50%)也具有较高的占比,显示出消费者对这两类饮料的较高认知。相比之下,醋饮料(16.10%)和固体饮料(16.90%)的占比最低,表明消费者对这两类饮料的了解程度相对较低。

2025年中国消费者饮用包装饮用水频率

数据显示,在中国消费者饮用包装饮用水频率中,最高的是“每周1-2次”,占比高达49.60%,显示出大多数消费者每周饮用包装饮用水的频率在1至2次之间。其次是“每周3-4次”,占比29.22%,说明有一部分消费者饮用频率较高。“每周5次以上”的消费者占比11.26%,“每月少于3次”的消费者占比最低,为9.92%。整体来看,大部分消费者饮用包装饮用水的频率并不高,主要集中在每周1-2次和每周3-4次这两个区间。

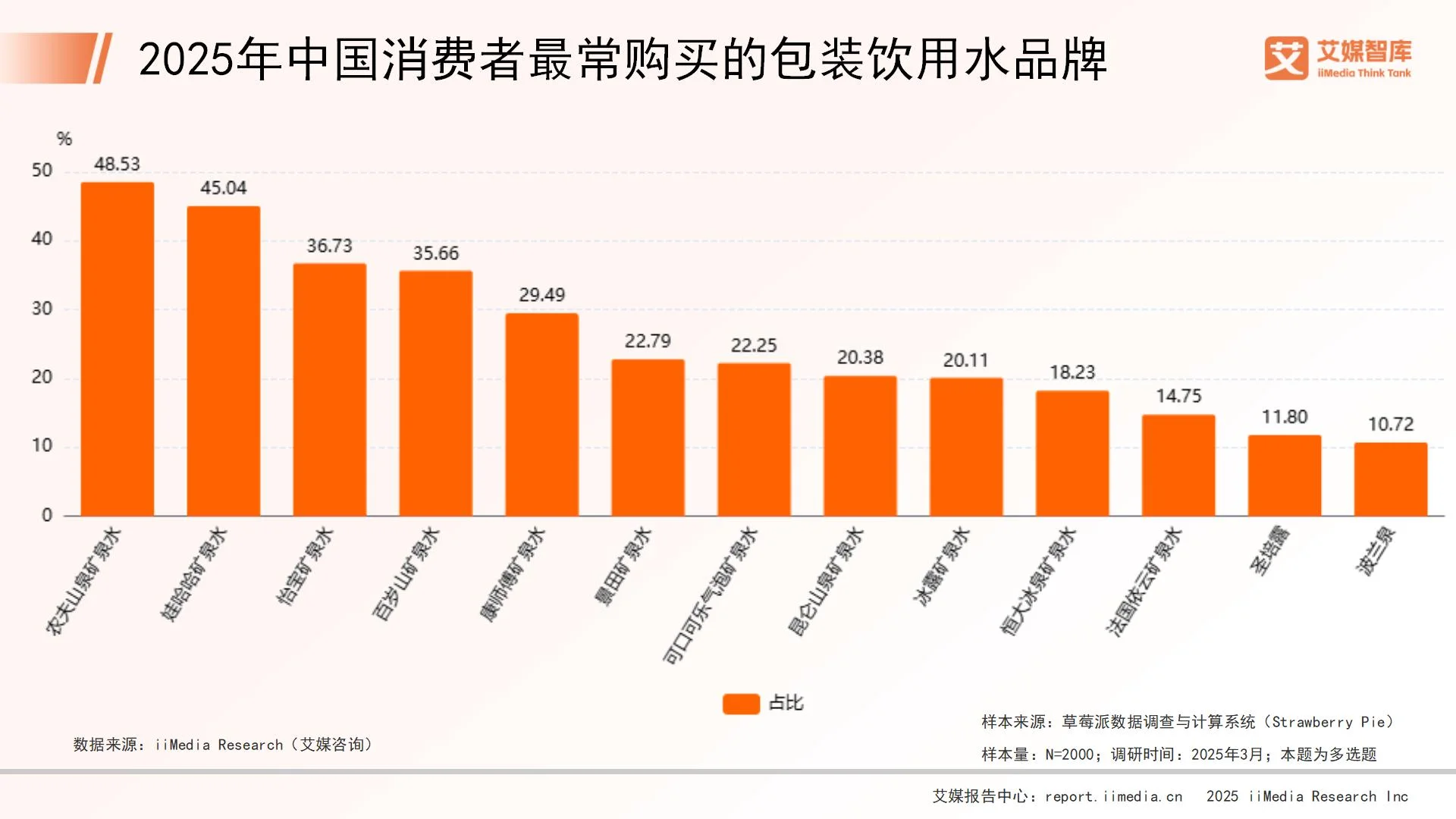

2025年中国消费者最常购买的包装饮用水品牌

数据显示,在2025年中国消费者最常购买的包装饮用水品牌中,农夫山泉矿泉水以48.53%的占比高居榜首,成为消费者最常购买的包装饮用水品牌。娃哈哈矿泉水占比45.04%,紧随其后。怡宝矿泉水占比36.73%,位列第三。百岁山矿泉水占比35.66%,康师傅矿泉水占比29.49%,均超过25%,表现不俗。景田矿泉水占比22.79%,可口可乐气泡矿泉水占比22.25%,昆仑山泉矿泉水占比20.38%,冰露矿泉水占比20.11%,恒大冰泉矿泉水占比18.23%,法国依云矿泉水占比14.75%,圣培露占比11.80%,波兰泉占比10.72%,这些品牌的占比相对较低。

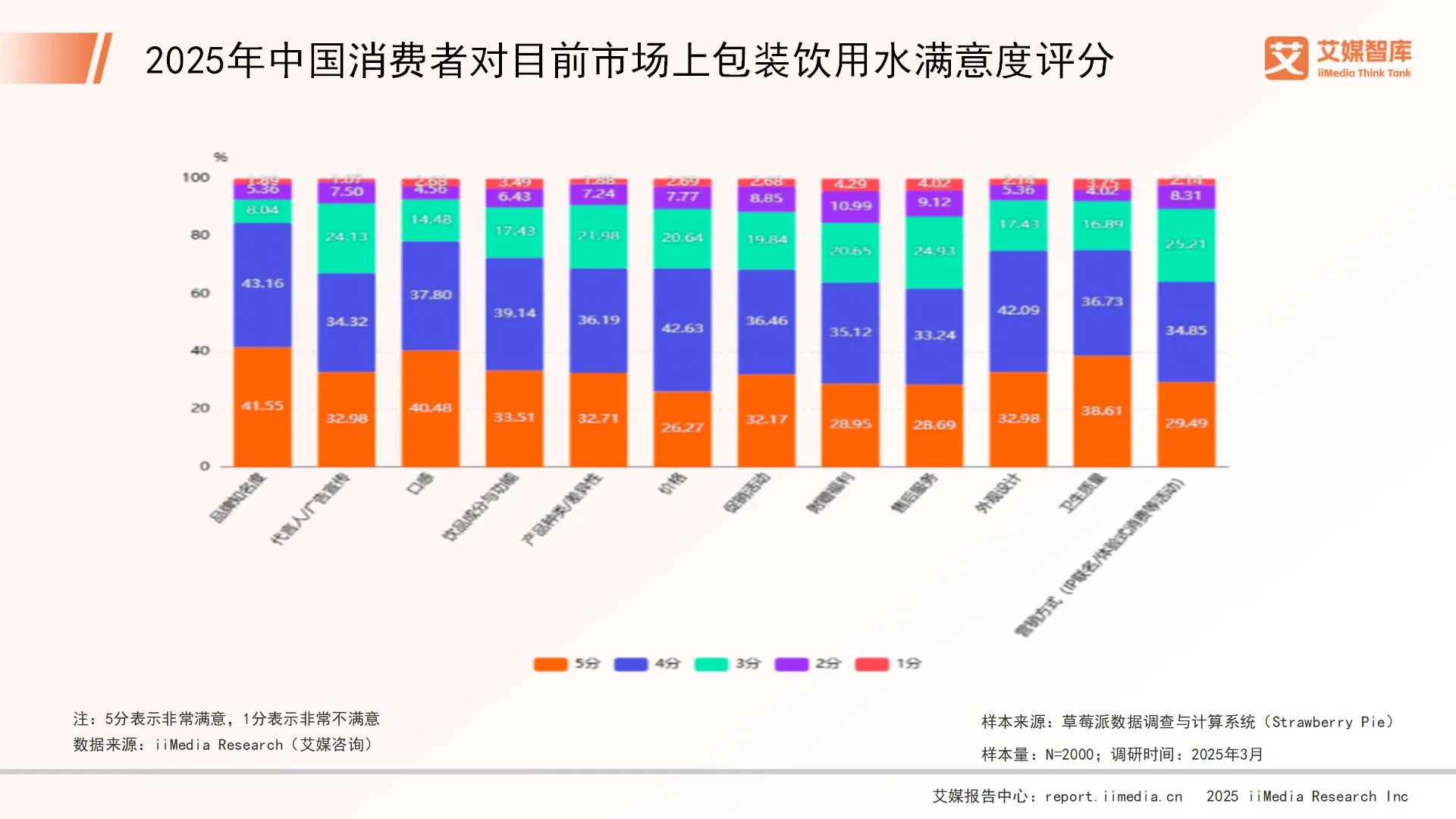

2025年中国消费者对目前市场上包装饮用水满意度评分

数据显示,在2025年中国消费者对市场上包装饮用水满意度评分中,品牌知名度以41.55%的5分满意度最高,其次是口感(40.48%)和卫生质量(38.61%)。售后服务和价格的5分满意度较低,为28.69%和26.27%,说明消费者对售后服务和价格敏感。整体来看,消费者对品牌知名度和口感最为满意,对售后服务和价格的满意度较低。

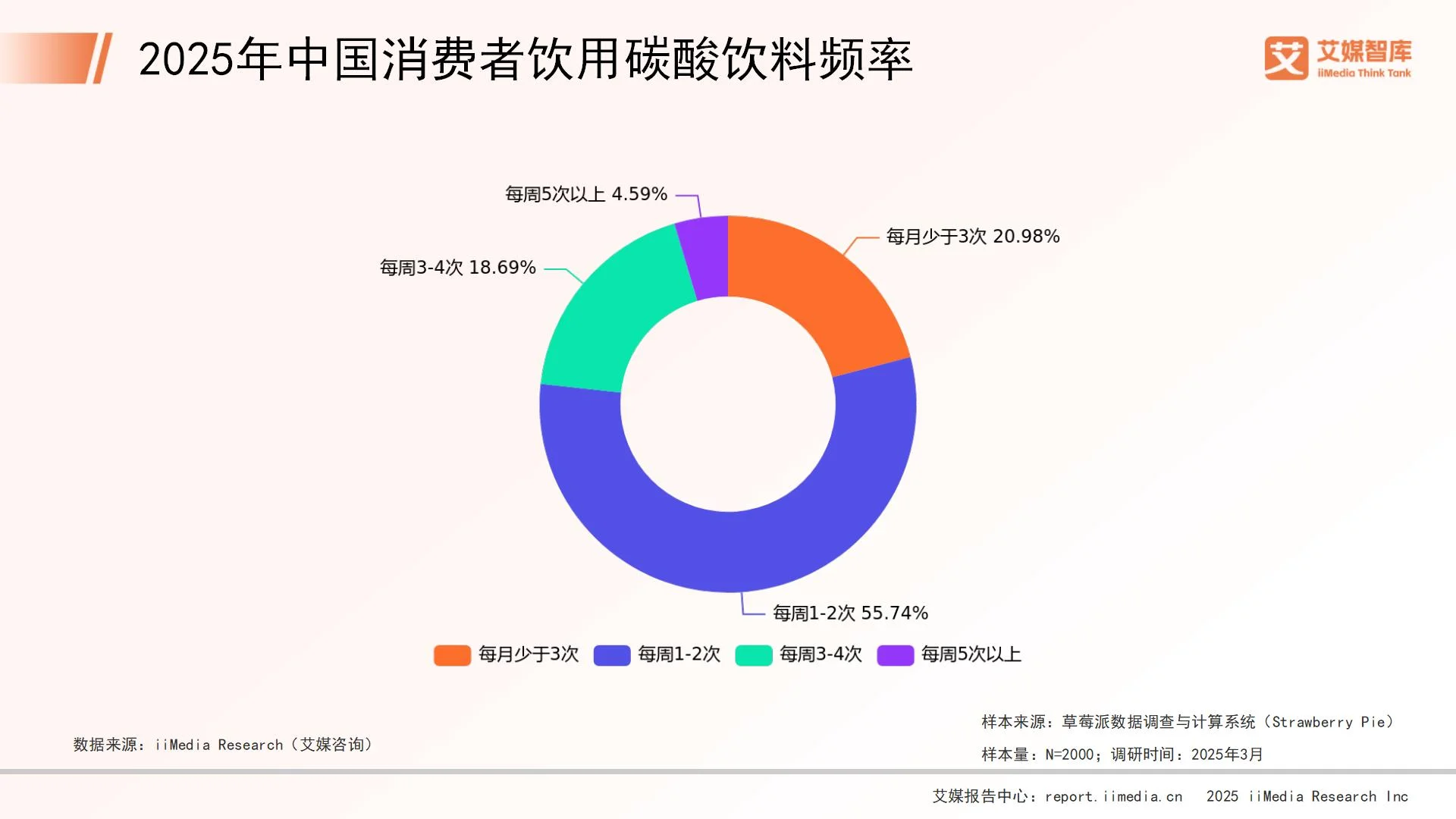

2025年中国消费者饮用碳酸饮料频率

数据显示,在2025年中国消费者饮用碳酸饮料的频率中,占比最高的是“每周1-2次”,达到55.74%。其次是“每月少于3次”,占比20.98%。“每周3-4次”的占比为18.69%,“每周5次以上”的占比最低,仅为4.59%。总体来看,大部分消费者饮用碳酸饮料的频率较低,每周1-2次的频率占比超过一半,显示出消费者对碳酸饮料的饮用较为节制。

微信扫一扫打赏

微信扫一扫打赏